Top 10 cryptocurrency

Additionally, the unfortunate reality is that some cryptocurrencies are nothing more than scams, launched in a matter of minutes via the processes described above. Founders hope they can make a quick buck while hiding behind the anonymity of the blockchain.< https://lise-dautry.com/ /p>

However, as with many of these copy-paste tokens, the fall has been just as dramatic. Safemoon has lost 99.9% of its value, trading close to zero, with a market cap of $3.3 million, at the time of this writing. Safemoon, according to CoinMarketCap, has been migrated over to a new version: SafeMoon V2.

The first chain to launch smart contracts was Ethereum. A smart contract enables multiple scripts to engage with each other using clearly defined rules, to execute on tasks which can become a coded form of a contract. They have revolutionized the digital asset space because they have enabled decentralized exchanges, decentralized finance, ICOs, IDOs and much more. A huge proportion of the value created and stored in cryptocurrency is enabled by smart contracts.

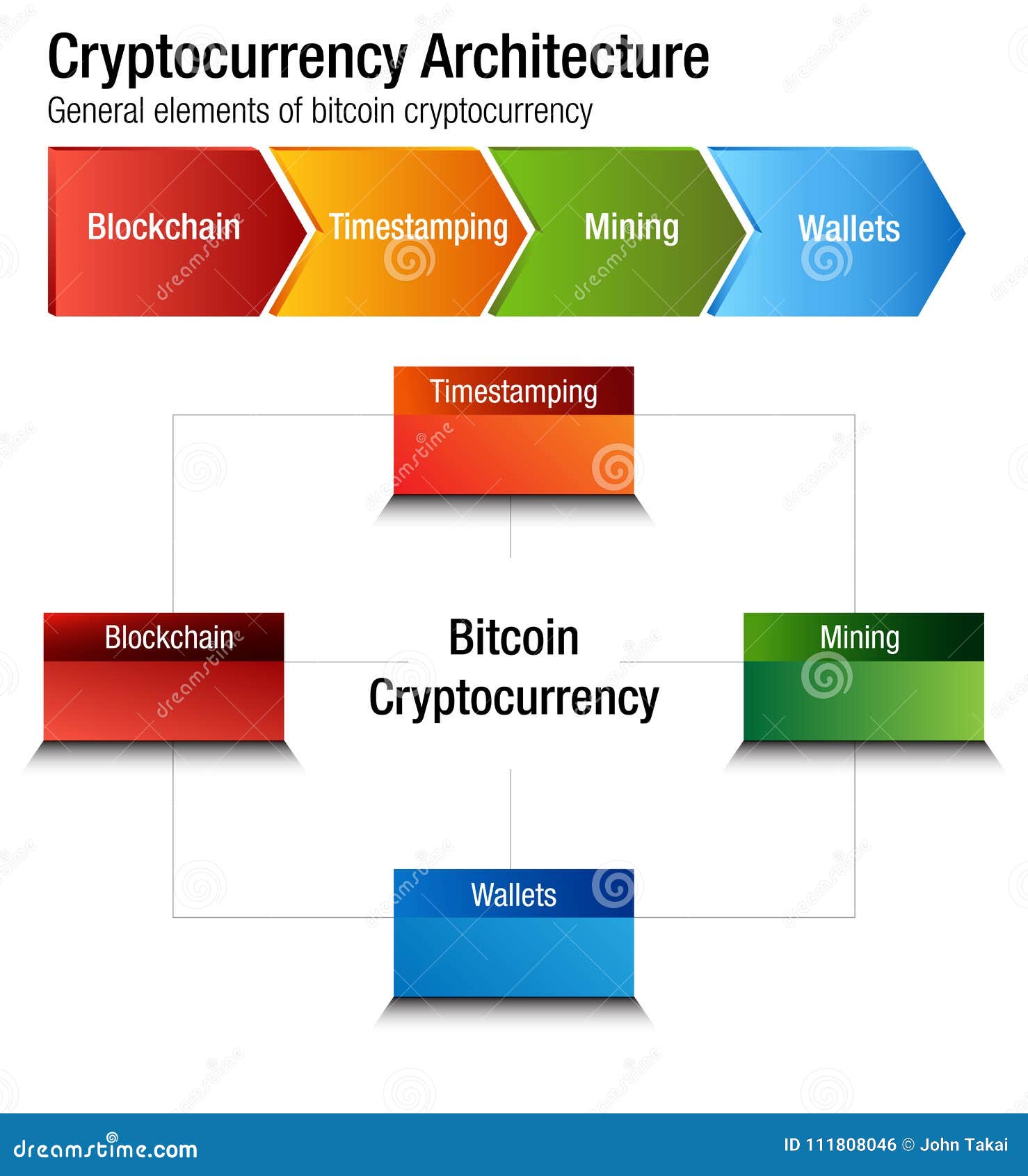

Cryptocurrency bitcoin

The news has produced commentary from tech entrepreneurs to environmental activists to political leaders alike. In May 2021, Tesla CEO Elon Musk even stated that Tesla would no longer accept the cryptocurrency as payment, due to his concern regarding its environmental footprint. Though many of these individuals have condemned this issue and move on, some have prompted solutions: how do we make Bitcoin more energy efficient? Others have simply taken the defensive position, stating that the Bitcoin energy problem may be exaggerated.

Preminen gebeurt bij Bitcoin niet, wat betekent dat er geen munten zijn die al gewonnen en/of gedistribueerd zijn tussen de oprichters voordat het openbaar beschikbaar is gemaakt. Tijdens de eerste jaren van het bestaan van BTC was de concurrentie tussen de miners relatief laag, waardoor de eerste deelnemers aan het netwerk een aanzienlijke verzameling munten hebben opgebouwd via normale mining: er wordt aangenomen dat Satoshi Nakamoto alleen meer dan een miljoen Bitcoin bezit.

Mempooltransacties worden periodiek gewist wanneer een nieuw blok wordt toegevoegd aan de blockchain. Transacties die nog wachten in mempools worden alleen gewist (verwerkt) zodra ze voldoen aan de minimumdrempel voor transactiekosten.

Surprisingly, the anti-crypto stance of the Chinese government has done little to stop the industry. According to data by the University of Cambridge, China is now the second-biggest contributor to Bitcoin’s global hash rate, only behind the United States.

Als een gebruiker slechts een deel van het saldo van een papieren wallet uit wil geven, moet eerst het volledige saldo naar een andere soort wallet — web, desktop of hardware — worden overgemaakt en vanaf hier een deel van het saldo uitgegeven.

Le Bitcoin n’a pas été préminé, ce qui signifie qu’aucun jeton n’a été miné et/ou distribué aux fondateurs avant d’être publiquement lancé. Néanmoins, durant les premières années d’existence du BTC, la compétition entre mineurs était relativement faible. Elle permettait aux premiers participants du réseau d’accumuler des sommes importantes de jetons en effectuant du minage standard : Satoshi Nakamoto à lui seul est supposé détenir plus d’un million de Bitcoins.

Cryptocurrencies

Experts say that blockchain technology can serve multiple industries, supply chains, and processes such as online voting and crowdfunding. Financial institutions such as JPMorgan Chase & Co. (JPM) are using blockchain technology to lower transaction costs by streamlining payment processing.

The current value, not the long-term value, of the cryptocurrency supports the reward scheme to incentivize miners to engage in costly mining activities. In 2018, bitcoin’s design caused a 1.4% welfare loss compared to an efficient cash system, while a cash system with 2% money growth has a minor 0.003% welfare cost. The main source for this inefficiency is the large mining cost, which is estimated to be US$360 million per year. This translates into users being willing to accept a cash system with an inflation rate of 230% before being better off using bitcoin as a means of payment. However, the efficiency of the bitcoin system can be significantly improved by optimizing the rate of coin creation and minimizing transaction fees. Another potential improvement is to eliminate inefficient mining activities by changing the consensus protocol altogether.

According to PricewaterhouseCoopers, four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. The Swiss regulatory agency FINMA stated that it would take a “balanced approach” to ICO projects and would allow “legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system.” In response to numerous requests by industry representatives, a legislative ICO working group began to issue legal guidelines in 2018, which are intended to remove uncertainty from cryptocurrency offerings and to establish sustainable business practices.

The rewards paid to miners increase the supply of the cryptocurrency. By making sure that verifying transactions is a costly business, the integrity of the network can be preserved as long as benevolent nodes control a majority of computing power. The verification algorithm requires a lot of processing power, and thus electricity, in order to make verification costly enough to accurately validate the public blockchain. Not only do miners have to factor in the costs associated with expensive equipment necessary to stand a chance of solving a hash problem, they must further consider the significant amount of electrical power in search of the solution. Generally, the block rewards outweigh electricity and equipment costs, but this may not always be the case.

On a blockchain, mining is the validation of transactions. For this effort, successful miners obtain new cryptocurrency as a reward. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network. The rate of generating hashes, which validate any transaction, has been increased by the use of specialized hardware such as FPGAs and ASICs running complex hashing algorithms like SHA-256 and scrypt. This arms race for cheaper-yet-efficient machines has existed since bitcoin was introduced in 2009. Mining is measured by hash rate, typically in TH/s. A 2023 IMF working paper found that crypto mining could generate 450 million tons of CO2 emissions by 2027, accounting for 0.7 percent of global emissions, or 1.2 percent of the world total